do you have to pay inheritance tax in arkansas

This answer only pertains to federal taxes as I know nothing about Arkansas taxes. There are only seven states that have an inheritance tax.

Divorce Laws In Arkansas 2021 Guide Survive Divorce

Arkansas does not have an inheritance tax.

. Of those seven states Maryland and New Jersey are the only ones that have both types of state level taxes. Each state sets its own exemption level and tax rate. Arkansas does not.

But 17 states and the District of Columbia may tax your estate an inheritance or both according to the Tax Foundation. An executor can charge a reasonable fee for managing an estate in Arkansas. The estate taxs amount depends on how big the estate is and where the deceased lived before they passed away.

Your relationship with the deceased. The percentage can range from 0 to 18 and there may be different rates for different types of property. Arkansas also does not assess an inheritance tax which is the second type of tax seen at the state level.

The Federal Estate Tax is imposed on the property of the recently deceased person before it is transferred to heirs. He or she can help you devise a strategy that meets your end. How much can you inherit from your parents without paying taxes.

Kansas also has an intangibles tax levied on unearned income by some localities. You will not be required to pay this tax because it should be levied before you get your inheritance. For instance in Iowa a surviving spouse parents grandparents children grandchildren and other lineal ascendants and descendants.

Estate planning is complicated so you should always speak with an estate planning attorney. The size of the inheritance. However the property that you inherit may have built-in income tax consequences.

Very few estates are subject to estate taxes given the current high exemption amounts. The inheritance laws of another state may apply to you if you inherit money or property from a person that lives in a state that has an inheritance tax. Each has its own laws dictating who is exempt from the tax who will have to pay it and how much theyll have to pay.

Although Arkansas has neither inheritance nor estate taxes on the state level the Federal Taxation is relevant for residents and properties located all over the United States. Long-term capital gains are capital assets held for more than a. According to law they cannot be more than 10 percent on the first 1000 value of the estate and five percent on the next 4000 and three percent of the remaining amount.

The state in which you reside. State Income Taxes and Federal Income Taxes. Income Tax Range.

En español Most people dont have to worry about the federal estate tax which excludes up to 1206 million for individuals and 2412 million for married couples in 2022 up from 1170 million and 2340 million respectively for the 2021 tax year. Even though Arkansas does not collect an inheritance tax however you could end up paying inheritance tax to another state. When you inherit property the basis in that property - your cost for purposes of determining gain or loss if you subsequently sell that property - is typically stepped up to the fair market value of the property as of the date of death.

In general an inheritance in and of itself is not considered income so you wont have to report your inheritance on your state or federal income tax return. Some family members wont have to pay inheritance tax at all. 57 on more than 30000 of taxable income for single filers and more than 60000 for joint filers.

This does not mean however that Arkansas residents will never have to pay an inheritance tax. The State of Arkansas cannot tax your inheritance. Arkansas does not have these kinds of taxes which some states levy on people who either owned property in the state where they lived estate tax or who inherit property from someone who lived there inheritance tax.

However out-of-state property may be subject to estate taxes from the state in which it is owned. While there arent any specific amounts or percentages for the fees they do have limits. The laws regarding inheritance tax do not depend on where you as the heir.

Generally the tax is a percentage of the value of the property being inherited. If the estate exceeds the 1206 million exemption bar the Federal Estate. Each state has different estate tax laws but the federal government limits how much estate tax is collected.

The amount of inheritance tax that you will have to pay depends on. To learn more about the inheritance process works contact Law Offices of David A. 31 on 2501 to 15000of taxable income for single filers and 5001 to 30000for joint filers.

If you inherit from somone who lived in. A short-term capital gain is the result of selling a capital asset you held in your possession for one year or less. Iowa for instance doesnt impose an inheritance tax on beneficiaries of estates valued at 25000 or less.

You might inherit 100000 but you would pay an inheritance tax on only 50000 if the state only imposes the tax on inheritances over 50000. Inheritances that fall below these exemption amounts arent subject to the tax. Do you have to pay tax when you receive an inheritance.

Note that estate taxes are separate and are usually paid from the trust estate before distributions to beneficiaries. In 2020 there is an estate tax exemption of 1158 million meaning you dont pay estate tax unless your estate is worth more than 1158 million. It is one of 38 states that does not apply a tax at the state level.

Executing An Estate In Arkansas What You Need To Know Milligan Law Offices

Estate Planning Strategies To Reduce Estate Taxes Trust Will

Foreign Inheritance Taxes What Do You Need To Declare

What You Need To Know About Tennessee Will Laws Probate Advance

How To Create A Living Trust In Washington Smartasset

Arkansas Income Tax Calculator Smartasset

What Happens If You Die Without A Will In Arkansas Cake Blog

Estate Planning Faq S Sexton Bailey Attorneys Pa

How To Create A Living Trust In Washington Smartasset

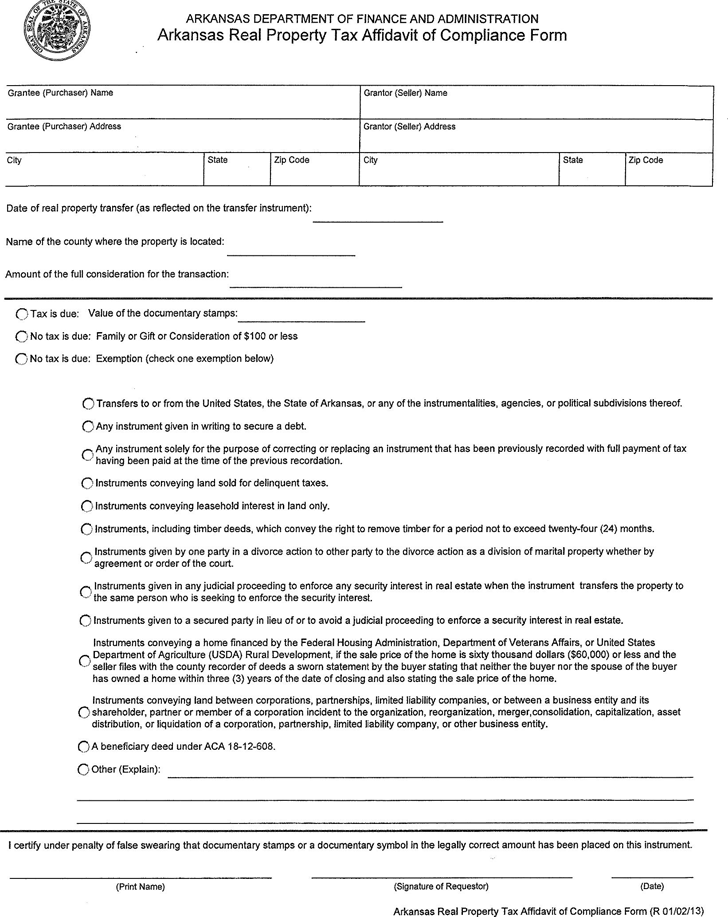

Free Arkansas Real Property Tax Affidavit Of Compliance Form Pdf 84kb 1 Page S

Arkansas Inheritance Laws Inheritance Loans Usa

How To Create A Living Trust In Washington Smartasset

States Where Residents Are Most Satisfied Estate Tax Inheritance Tax Inheritance

Estate Planning Faq S Sexton Bailey Attorneys Pa

Gift Tax How Much Is It And Who Pays It

Arkansas Income Tax Calculator Smartasset